The ongoing coronavirus pandemic is impacting every part of our lives, including how and where we shop and what we buy. This has wide-ranging ramifications for marketing and eCommerce.

To help you benchmark your online sales performance against your peers, we’ve summarized the top trends we’ve seen across key eCommerce verticals during the covid-19 crisis, focusing on March, April and May 2020.

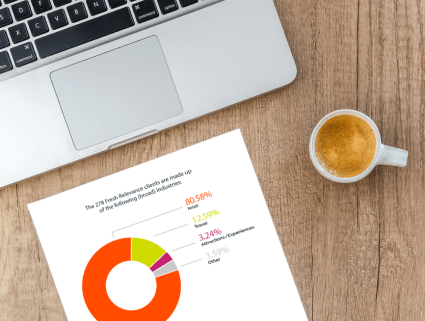

About Fresh Relevance

Fresh Relevance is a leading SAAS (Software-as-a-service) eCommerce personalization platform, leveraged by brands to increase revenue using web, app, email and SMS personalization.

Analyzed companies

We looked at the impact of Coronavirus on eCommerce – specifically on 278 Fresh Relevance clients in a variety of industries:

Of the companies whose data was analyzed, 67.27% were based in the UK, 15.11% in the Nordics, 11.51% in North America, and the remaining were from other countries in Europe and around the World.

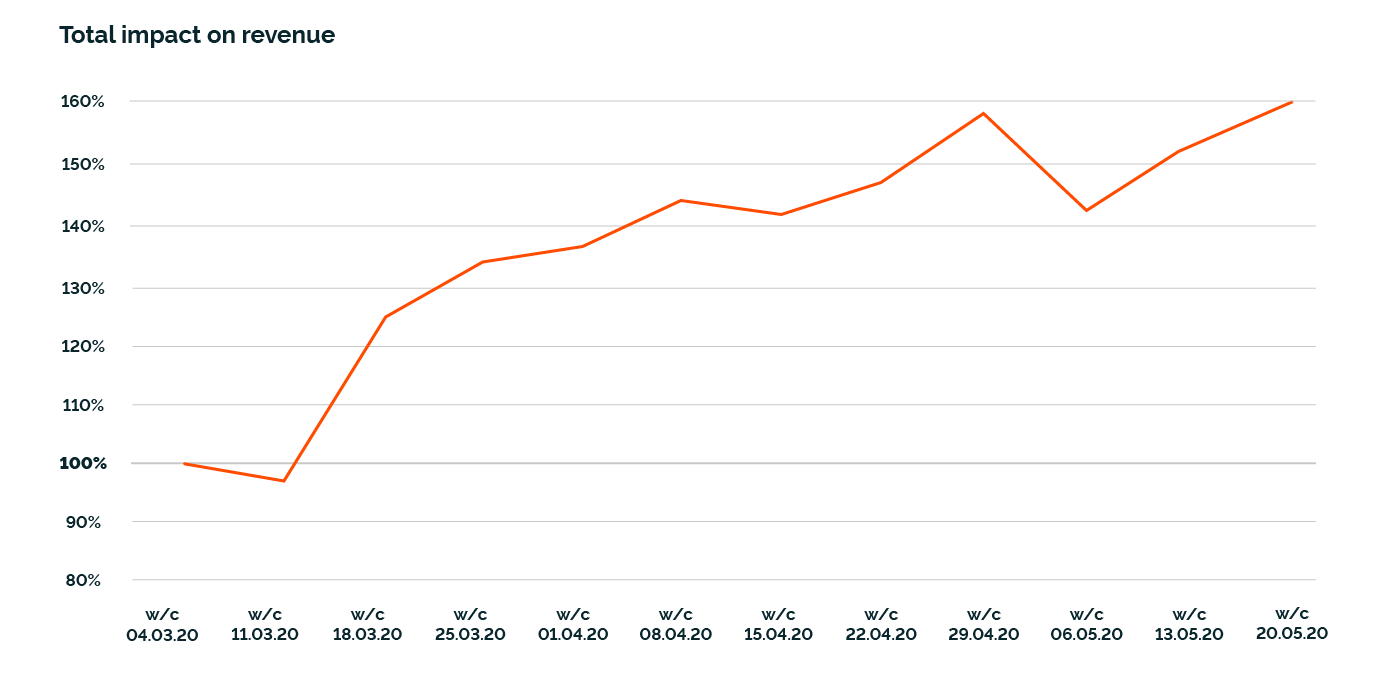

Looking at the pandemic’s impact on eCommerce revenue, we noticed that despite a slight dip at the beginning of March, throughout the rest of the month sales grew. Since then, throughout April and May there has been a further rise in sales, although the incline is less steep, growing more gradually to sit at 159%, as consumers have adapted to their new routines and shifted their focus to online retailers rather than brick-and-mortar stores.

Trends by industry

New social distancing measures have had varying impacts on different industries which operate online. The following trends can be seen for the industries analyzed:

Average revenue impact is calculated by adding all the revenue impacts seen by the sampled businesses together, and then dividing them by that sample size. If a small number of businesses are seeing revenue much higher or much lower than the majority, this can influence the average by bringing it up or down respectively. Whilst this accurately reflects the situation, the median can also be examined to identify revenue impacts without the influence of outliers. The median is the midpoint in the dataset, and can be a better indicator of what revenue impact the majority of businesses will be seeing.

Online Retail

Online shopping within retail saw a significant rise in revenue throughout March, growing to 160% by the end of the month. April and May saw retail sales level out to stay between 160-180% of what they had been at the beginning of March.

The median, as seen below, when compared to the mean however, highlights that this average is high as it has been brought up by certain businesses performing extremely well throughout the changes brought on by the Covid-19 social measures. In looking at the median, it is clear that a lot of businesses have seen their sales stay stable, and as lockdown measures have been loosened, even grow slightly with the median at the end of May being 131% normal revenue. To uncover which verticals within retail are performing better, with customers making more online purchases, in the next section we will break down revenue impact within retail further.

Travel

The travel industry has been heavily impacted from March to May 2020 due to restrictions being placed on movement. During March sales fell on average to as low as 10% of sales at the beginning of the month.

Throughout April, there was a slight increase to as much as 33% of normal sales, with this growing even further to as high as 66% in May. The median has remained lower at between 6%-10%. This suggests that certain businesses within the travel industry have managed to adapt and tailor their offering to the current situation as time has gone on, but for the majority there has been no change in the past month. The average revenue has been growing steadily, as consumers start to plan ahead and book travel for later in 2020 and into 2021.

Attractions/Experiences

Similarly, attractions and experiences have seen a sharp decrease in sales as a result of social distancing measures. Revenue had dropped to 12% in March, and throughout April remained between 15%-18%. In May it grew as high as 23%, showing a slow but steady increase.

Media

The online media industry, despite an initial decrease in revenue, has seen their average sales soar to as high as 365%, with revenue at the end of May being at 241%. The online media industry has shown a less steady revenue progression and has seen more spikes, over all in a positive trend.

Other

For industries outside of retail, travel, media and attractions/experiences, such as charities, education and recruitment, the impact of Covid-19 has been more changeable week by week. It has ranged between 67% normal revenue, to as high as 228%.

Taking a closer look at retail

Whilst as a whole, retail saw a rise in revenue across during March, April and May, different sub sectors experienced varying impacts.

Sectors which have seen their revenue and online retail sales more than double during this period of social distancing are Toys/Games (448%), Gifts (459%), Books/Film (237%), Tobacco/Vaping (265%), Food/Drink (211%) and Home/Garden (215%). Each of these industries has been naturally suited to supporting #stayhomesavelives, which has seen them perform very well due to high demand during this time.

Other verticals which have seen an increase in revenue from people shopping online between March and May are Technology (197%), Sport/Hobbies (157%), Pet Supplies (148%), Beauty (140%), Fashion (139%), Health (134%), DIY/Construction (121%) and Jewellery/Luxury Goods (112%).

Industries which have seen a fall in revenue are Office Supplies (75%), Automotive (78%) and Insurance/Finance (59%).

Most eCommerce businesses within retail verticals seem to have been able to benefit from the pandemic, with insurance/finance, office supplies and automotive being the exceptions.

However even automotive has been able to recover sales in May, with average revenue sitting at 126% at the end of May, as people start to use cars again to avoid public transport when returning to work from the office. Whilst not yet seeing revenue back to normal, office supplies have also seen their revenue begin to increase slightly as offices move towards reopening, with revenue at 80% at the end of May, having dipped down to 45% during April. Similarly insurance/finance is starting to see some slow growth in a positive direction.

Verticals like fashion and jewellery/luxury goods seem to have enjoyed a boost in May too as people are getting ready to return to work and updating their wardrobe due to the sunny weather. The growth for jewellery/luxury goods has been substantial enough throughout May to bring average revenue for the whole period above usual revenue, whereas in April the industry was on average seeing a loss.

Food/drink online sales have begun to decline throughout May after weeks of stockpiling. This comes as more shops are reopening and consumers feel less need to bulk buy items. At the end of May average revenue did still sit at 153%, but is significantly lower than the peak of 282% when more restrictions were in place.

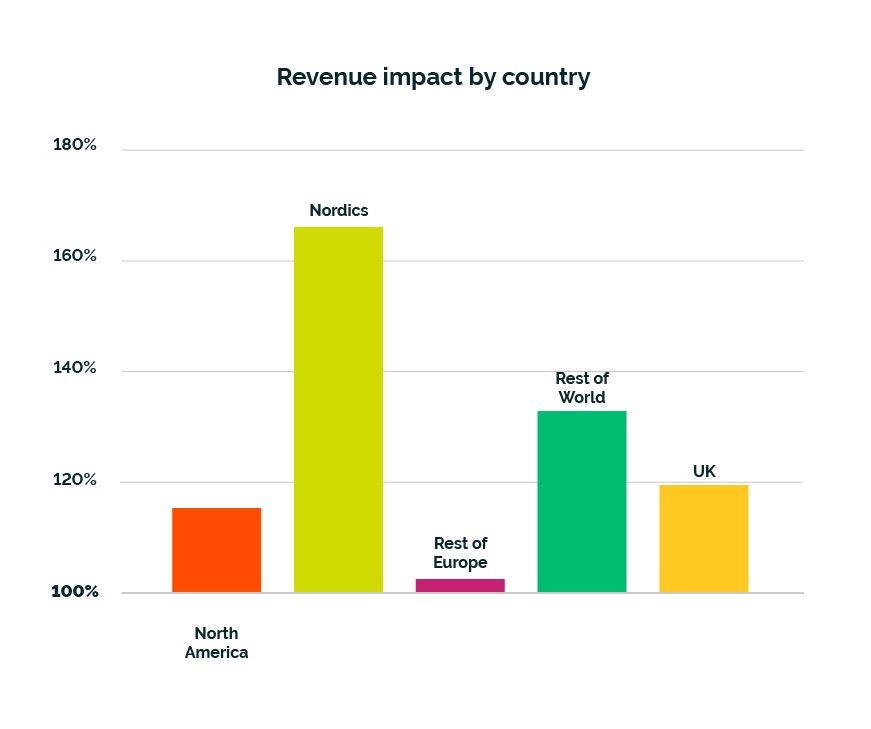

Does the impact on revenue differ by geography?

For most areas of the world, online shopping and spending has increased. This increase has been higher in areas like the Nordics where average revenue has been at 166%.

The United Kingdom has seen its online sales grow steadily from 90% average revenue at the beginning of March to 157% at the end of May.

The rest of Europe, which initially saw revenue grow, followed by a decline and then returning to an increase from the end of April to the end of May. The region has seen an average of 115% of normal revenue.

North America, which throughout March saw revenue decrease to as low as 92%, has throughout April and May seen it grow steadily to 172%, with the average throughout the whole analyzed period being 126%.

The impact upon revenue for the rest of the World has varied more, but on average has increased to about 158% of normal sales.

What does this data mean and how can marketers adjust accordingly?

The most significant takeaways from this data are:

- On the whole, revenue has been steadily increasing for online businesses, as consumers have shifted their normal spending patterns to follow social distancing guidelines.

- Travel and attractions/experiences have seen the most significant drop in revenue as a result of the introduced home isolation rules. Throughout May, however, revenue has started to increase again as businesses adapt to current guidelines, and as consumers begin to plan travel again.

- Industries well suited to supporting consumers remaining at home have seen the most significant increases in revenue throughout this period. Other industries are now starting to see growth too as their customers prepare to return to work.

These numbers can act as a benchmark for your business, but what can you do to engage with your customers and lessen the impact of Covid-19 on your business?

Fresh Relevance is here to help, with advice on how marketers can adjust their ecommerce strategy during #stayhomesavelives and inspiration on how you can shape your marketing campaigns.