Players like Amazon are transforming the retail industry. Those that both survive and thrive are the ones that focus relentlessly on the customer. They obsess about customer KPIs in the boardroom, and they’ve organized their teams and technology to be able to focus on customer-oriented goals like boosting the 12x buyer rate and preventing churn.

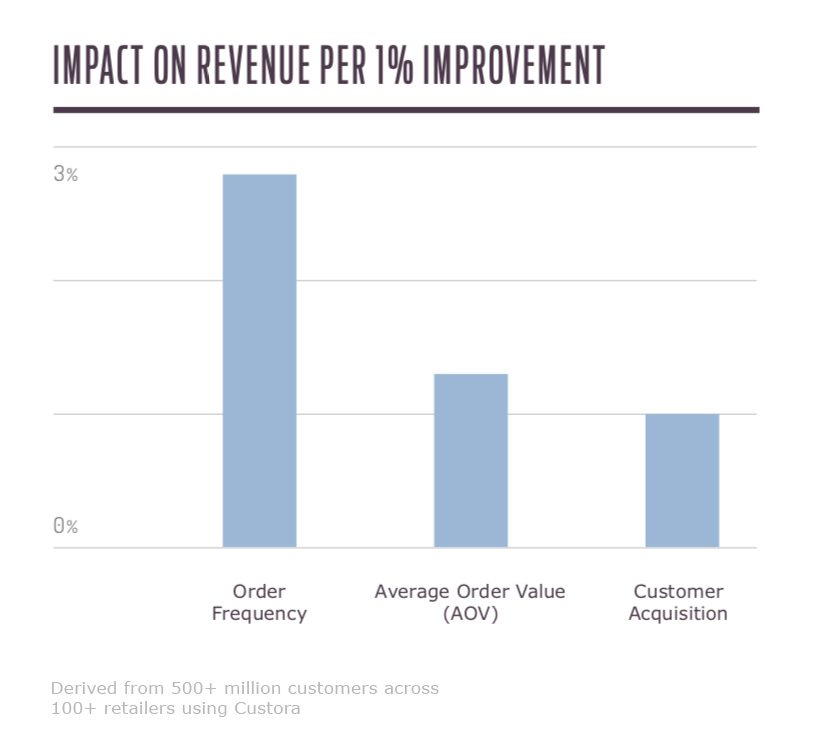

To understand which customer KPIs are responsible for stellar growth, customer analytics company, Custora, examined five drivers of growth from over 100 of our retail customers (over 500 million end customers and 150 billion dollars in annual transaction volume) and uncovered the metrics that matter.

This report strives to answer two of the biggest questions that retailers are asking themselves today: Which customer KPIs are the biggest drivers of growth, and what can retailers do to improve them? “This research will help marketing leaders prioritize the customer metrics that matter most for driving growth,” says Corey Pierson, Custora CEO. “And with that research, we’ll turn this ‘retail apocalypse’ into a retail resurgence.”

The findings? Acquisition is a reliable but inefficient way of driving top-line growth. The savviest retailers are focusing on increasing the engagement of their customers while they’re active—a strategy that drives three times the growth of acquisition.

Creating new engagement opportunities by shortening inter-purchase time is the fastest path to growth. And with the amount of customer data available to retailers today, they have more insight than ever into how their marketing strategies are creating customer value.

What’s driving retail growth?

To understand the drivers of growth, these five customer-centric KPIs were examined year over year for retail customers. These KPIs are the single most important source of visibility into how your marketing strategies are creating and retaining customer value.

| Customer acquisition | The number of new customers a retailer acquired over the course of a year. This KPI allows retailers to benchmark how successfully they drove new customers to purchase from their brand. |

| Average order value (AOV) |

The average basket size. This metric is calculated by dividing a retailer’s revenue by the number of orders over the course of a year. |

| Order frequency | The average number of orders per transacting customer over the course of the year. |

| Retention rate | The number of customers who made a purchase over two consecutive years. A customer who has made a purchase over two consecutive years is generally assumed to have been “retained.” |

| Reactivation rate | The number of customers who transacted after more than a year of not transacting. These customers are generally assumed to have been lost and then “reactivated.” |

The data showed that revenue increased 17.2% on average, with customer acquisition and average order value also increasing. Of the five metrics tracked within this report, retailers were most successful at growing the number of new customers and least successful at reactivating lost customers.

However, these results aren’t totally conclusive—these retailers may have been most successful at acquiring new customers, but this doesn’t mean that acquisition is always the most efficient way to drive growth.

The report takes a deeper dive to understand the relationship between each of these metrics individually against growth rate, discovering a positive correlation. Focusing on any one of those metrics is good for your business—there’s no question about that. However, it is important to understand tradeoffs. What’s the unique contribution that each driver brings when we factor in the idea that some of them might have a correlation?

Creating new engagement opportunities is the fastest path to growth

The analysis uncovered that of all five drivers, order frequency was the most efficient driver of growth, offering the biggest bang for your marketing buck. For every 1% increase in order frequency, there was a resulting 2.8 point increase in revenue.

While order frequency and average order value were the two most effective drivers of growth, the two other metrics, retention and reactivation rate, had no effect on revenue growth. This tells us that simply getting a lapsed customer to come back and make a single purchase isn’t enough—in order to drive growth and encourage repeat purchases, marketers need customers to meaningfully re-engage.

This is a powerful message for retailers. It’s not enough to simply lure lapsed customers back with steep discounts—retailers need to re-educate customers on their value proposition and rebuild the relationship with them.

How marketers can grow order frequency and basket size

Now that it has been determined that shortening inter-purchase time is the key to growth, what strategies can marketers employ to increase retention of active customers?

The answer is simple: cultivating long-term relationships with customers from the moment they first engage with the brand and stepping in with the right message when they show signs of fading away.