After months of brick-and-mortar stores on the highstreet being closed, staying at home and adjustments to every part of our lives, June 2020 saw changes that started to shift the scales back to “normal life”. Highstreets slowly started to reopen, some people returned to work, and families and friends had more freedom to spend time together.

How has this impacted marketing and eCommerce though? We have been analysing the impact of Covid-19 on revenue across many eCommerce business verticals for the past months. Now, we can look at how online shopping is changing as measures are relaxed and physical stores are opening back up.

To help you benchmark your performance against your peers, we’ve summarized the top trends across a sample of over 250 Fresh Relevance clients from a variety of industries, looking at consumer behavior and new consumer habits.

Revenue

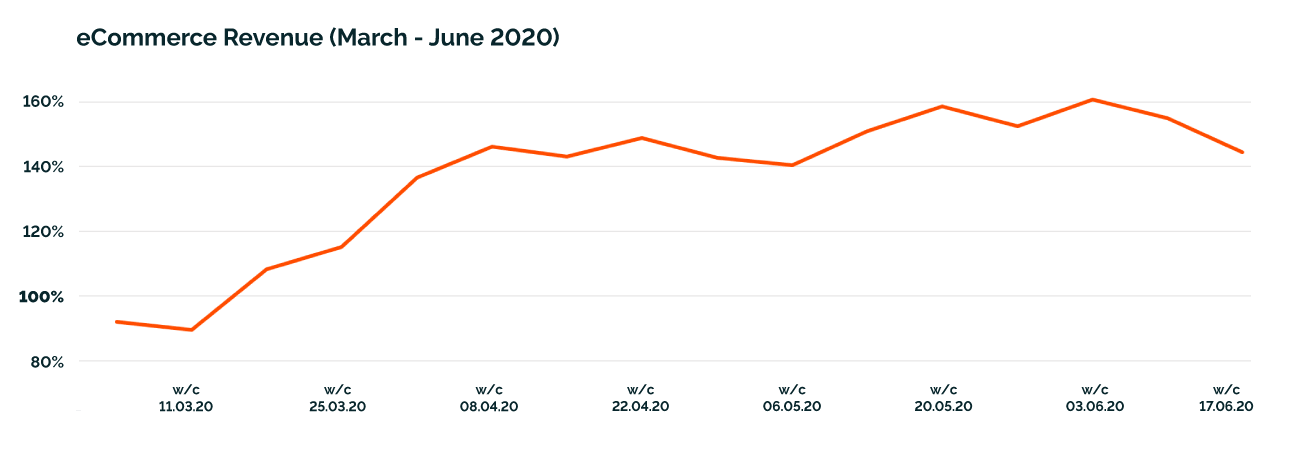

The past few months have seen online sales grow as consumers shifted their shopping online due to lockdown restrictions.

The peak of online revenue since the beginning of March was the week before shops opened, at 161% usual revenue – as consumers bought products to prepare for their returns to work and socialising, many still opted to shop online. When the UK highstreet reopened in mid June, the revenue dropped ever so slightly to 155%, and then the following week to 145%.

This shows us that most consumers are still opting to making online orders as opposed to returning to shops in person, but there is a slight indication that there will be some footfall on the highstreet.

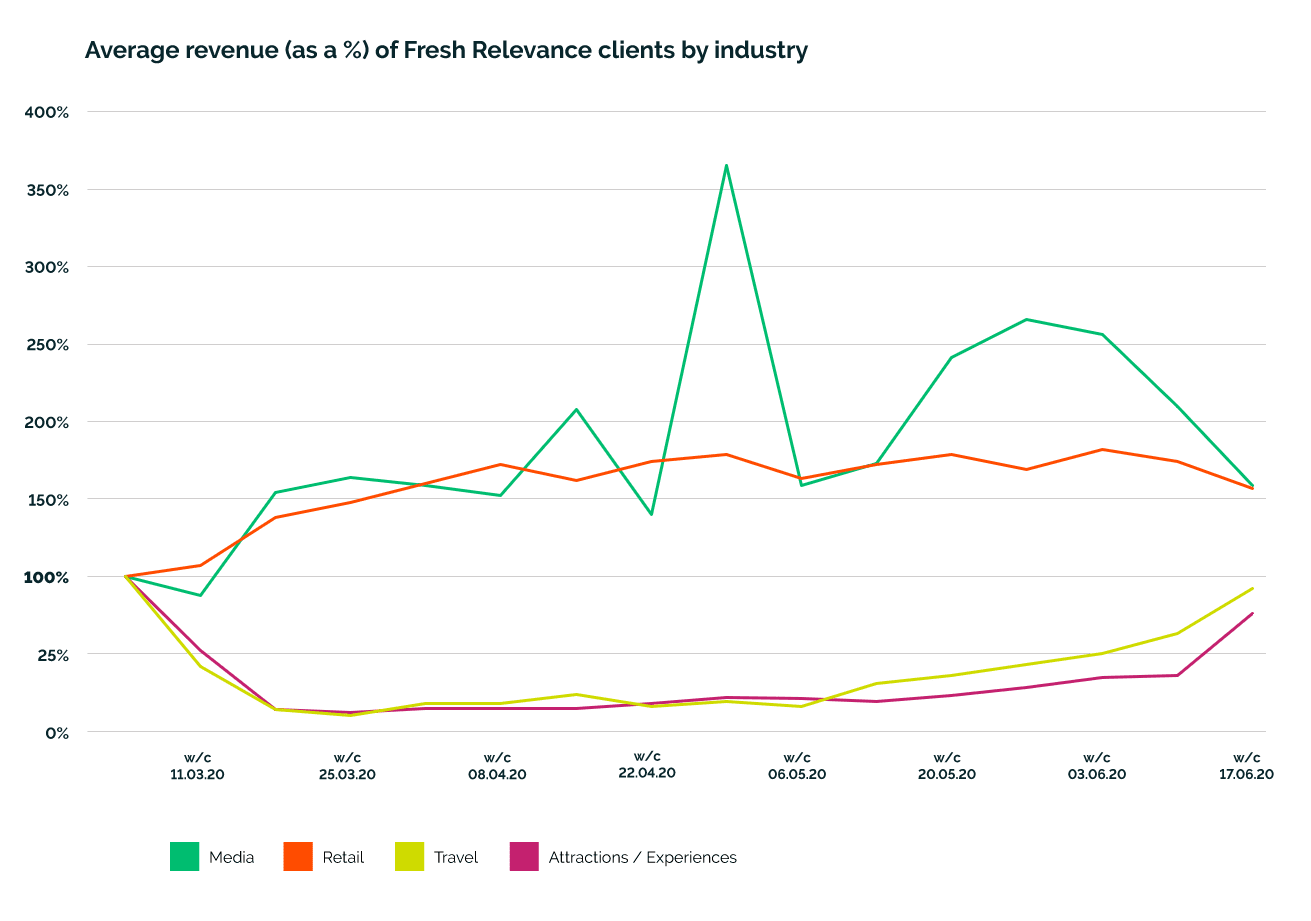

Revenue impact by industry

Online retailers are an industry that has consistently seen a positive impact upon its revenue throughout the crisis. Media has also seen a positive impact, albeit with more variation during Q2, as consumers turned online to get the latest news and entertainment. Throughout June, this has remained largely the same.

For travel and attractions/experiences however, June has seen revenue growth as an eager population is given more possibilities for travel and breaks. We will further analyse the verticals within travel to see where this uplift is coming from. From an overall perspective though, it is clear that there is at last good news for some of the worst affected businesses.

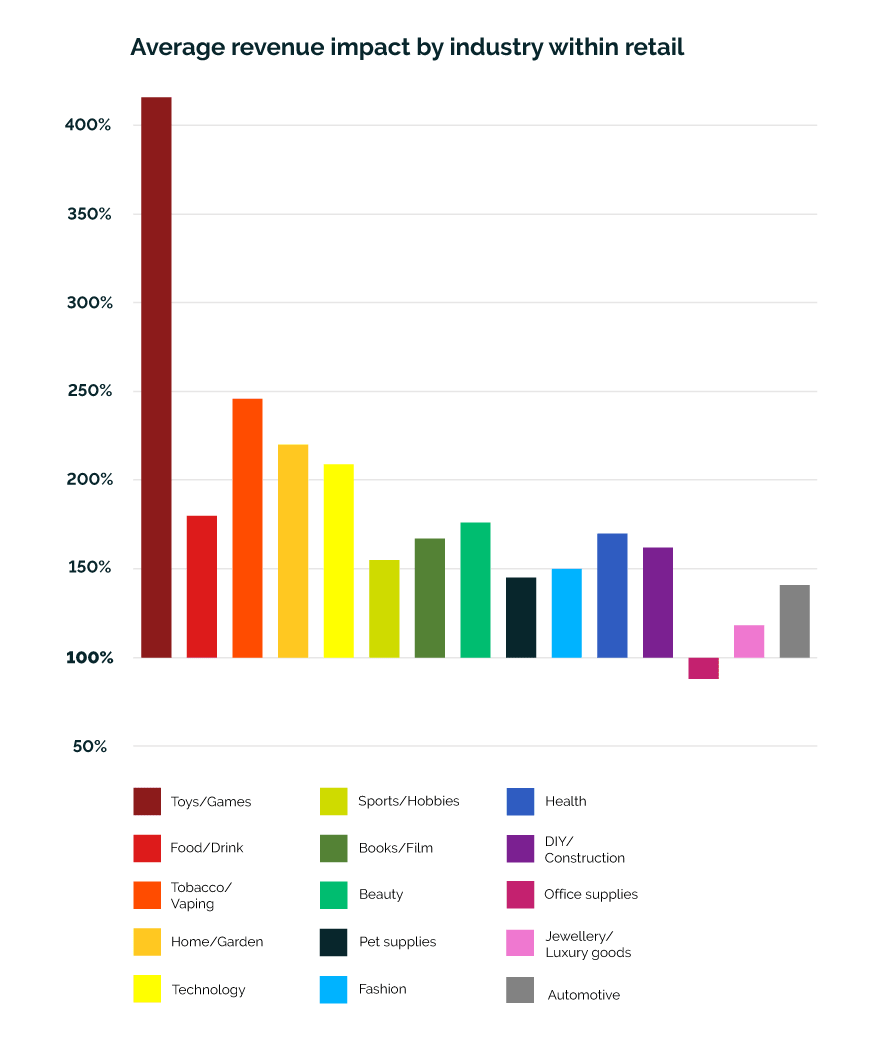

How have retail verticals been affected?

The graph below shows the average impact by industry within retail in June. Almost all industries are now seeing either a positive impact on their sales, or a return to pre-Covid online revenue, with the exception of online transactions for office supplies which has still seen on average much lower demand, even as offices begin to open again.

As you can see from the graph below, which shows the impact upon each industry throughout time, there is a different trend for each industry across the same period.

Throughout most of Q2 the automotive and jewelry/luxury goods industries were seeing lower revenue than they would normally, as the population wasn’t driving anywhere or socializing in the way they usually would. As we emerge into a new normal, people have been shopping accordingly, getting ready to go places and see people they haven’t in months, maybe even dressing up for the first trip to a restaurant in over 100 days.

Industries such as toys/games, home/garden, technology and sports/hobbies which were perfectly placed for keeping people entertained and healthy throughout the many months at home saw phenomenal internet sales. These online retail sales are still high, but are beginning to taper down slightly, both as demand is reducing and the population is presented with more options becoming available to keep themselves and their families amused.

The slight return to normal life has seen for all industries a move closer to their usual revenue, even for those still performing incredibly well. If you compare the average revenue in June to that of the previous quarter, there is much more of a cluster around the usual 100% mark.

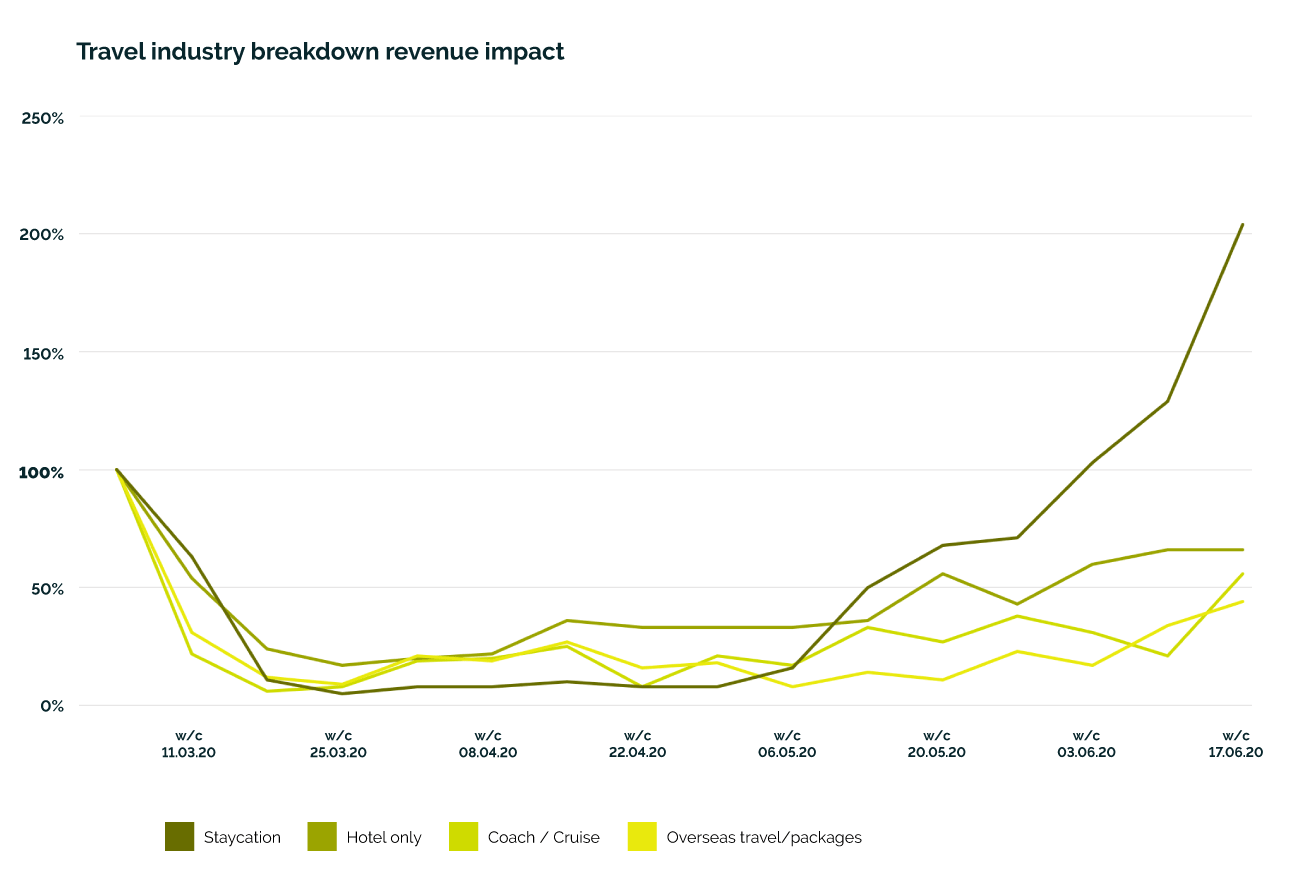

Breaking down the impact on the travel industry

The easing of many restrictions on movement has had a positive impact on the travel industry.

The most staggering impact has been on travel businesses offering “staycations”. These are well suited to the current situation, as they can be booked for a more immediate holiday, with less anxiety about whether or not borders will stay open. By the end of June, the staycation industry’s revenue was growing rapidly and was at 204% their normal revenue.

For the rest of the travel industry, whilst revenue is not yet at a pre-Covid level, there is definite growth as eager globetrotters begin to plan their holidays for 2021.

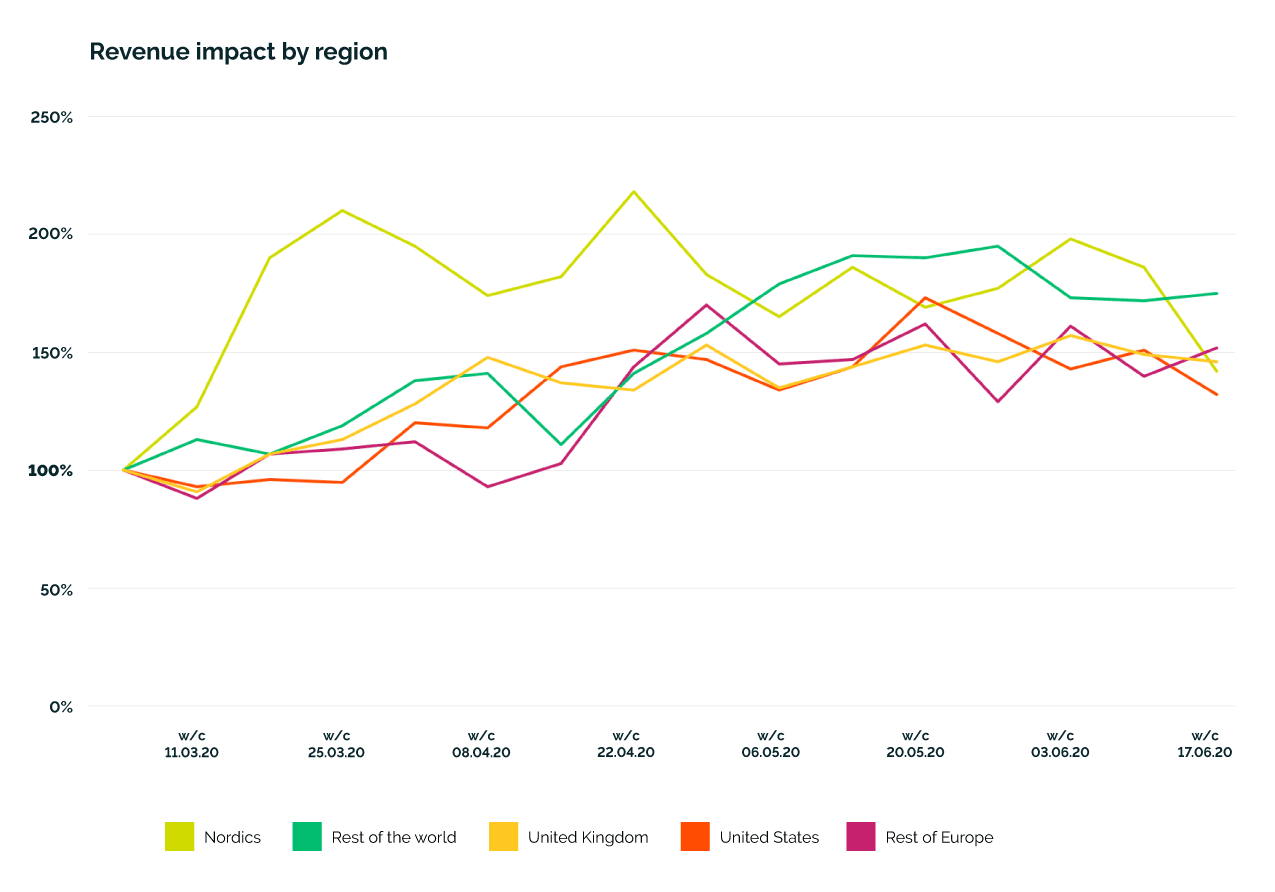

Is there a difference by region?

Across the globe, online revenue has grown throughout Q2. As restrictions have been lifted and then in some cases, been put back in place, in different countries and regions throughout the world, the revenue trends have all evened out and stayed between 130% to 190% even since the beginning of May.

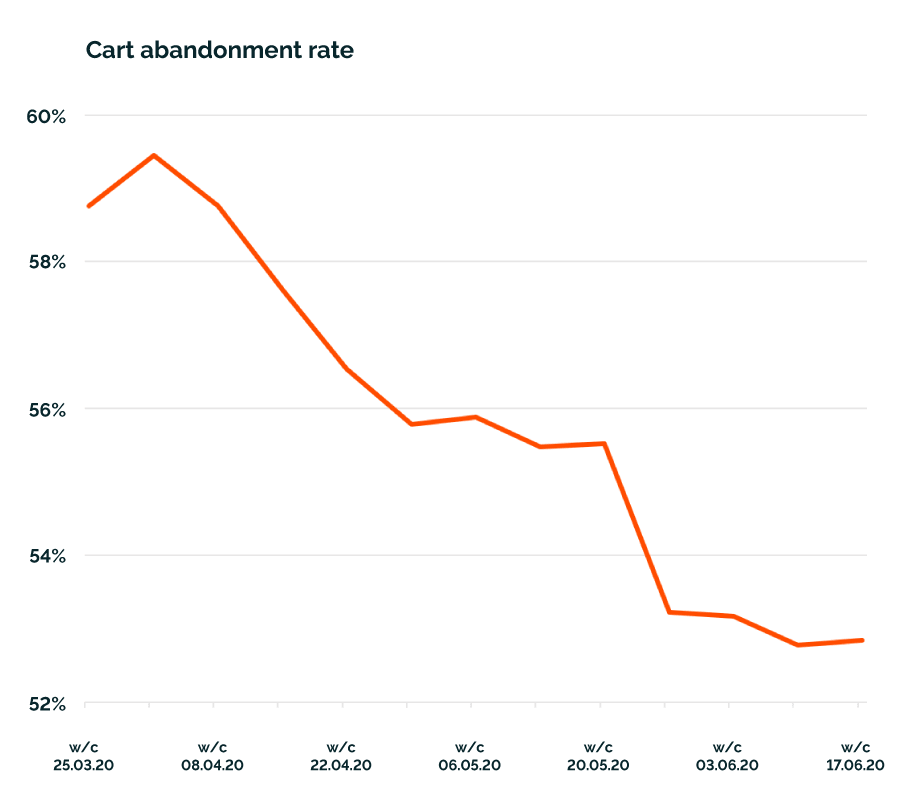

The impact on cart and browse abandonment

As well as having an impact on revenue, there has been an impact on the behavior of online consumers throughout the past months.

During the past few months, the cart abandonment rate has dropped, going from as high as 59% down to 52%. This suggests that consumers have been shopping with more purpose and due to actual need, rather than browsing more as a hobby.

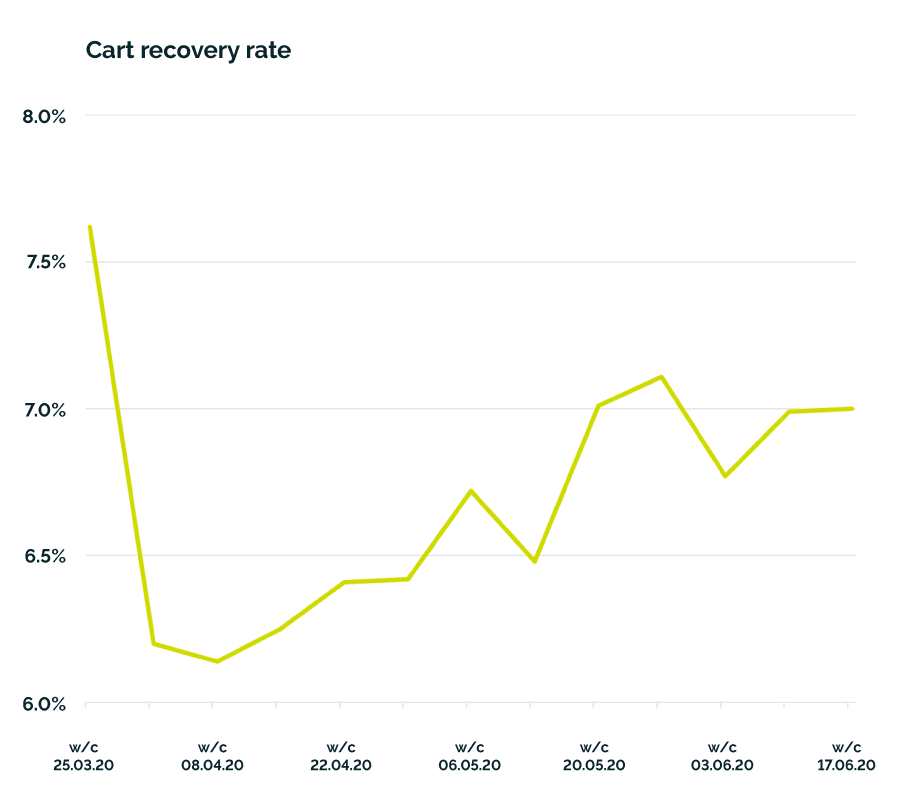

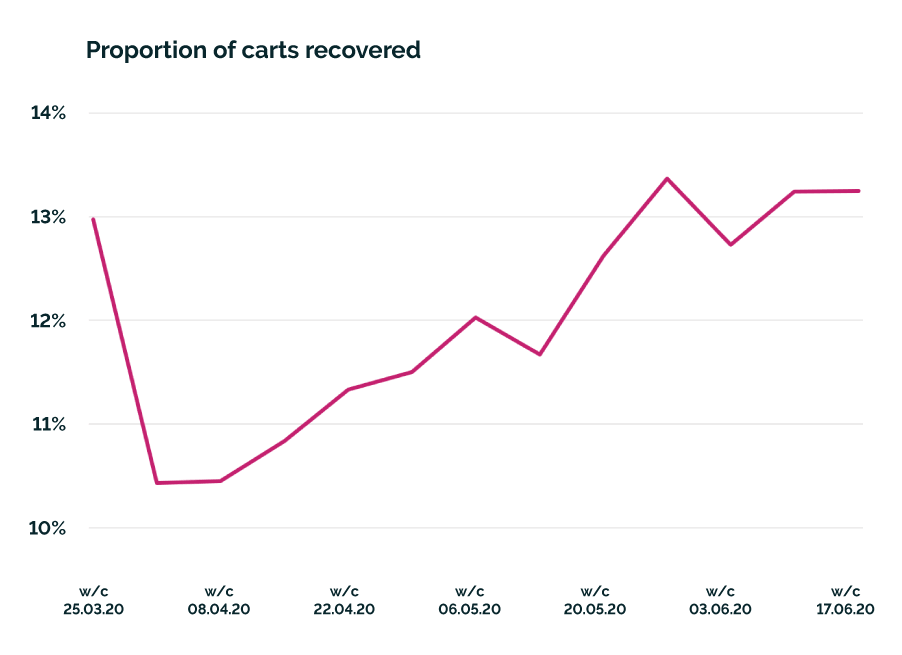

Similarly, despite an initial drop, cart recovery rate has gone up which shows that cart abandonment strategies have been working effectively. Overall throughout the periods of #stayhomesavelives and even as we emerge from that, the proportion of carts recovered has grown to over 13%.

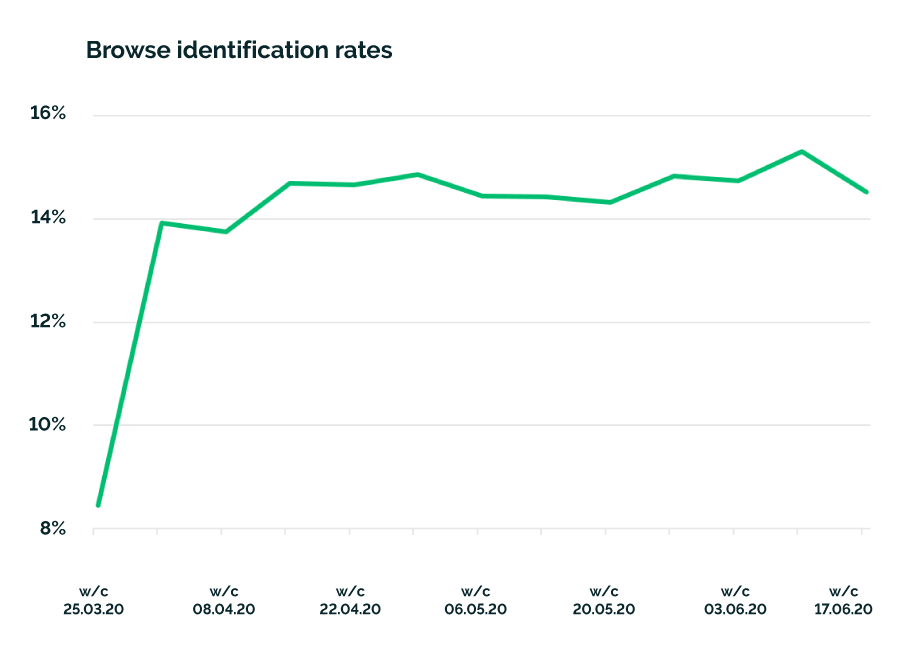

Browse identification rates have also grown again, peaking at 15.32% despite initially dropping as consumers ventured online to do their shopping. Compared to the usual level of around 10%, there is a lot of opportunity to market to this new pool of customers and encourage them to make online purchases. This demonstrates that once people had shifted their shopping patterns towards online sales, they returned or identified themselves more readily.

Overall, the sales uplift from a cart or browse abandonment strategy has been substantial throughout the second quarter, and entering Q3. In a break from normal patterns, browse recovery strategies have accounted for more uplift than cart.

With less distractions whilst at home, and more of a reliance on online shopping rather than in physical stores, this can account both for lower abandonment rates but also consumers responding more to cart and browse abandonment strategies, which help them along their buyers journey.

What does this data mean for marketers?

The most significant takeaways from this data are:

- Revenue has been returning gradually towards a more normal level, but most verticals within retail are still seeing their revenue sit higher, at an average of 157% normal.

- Travel, especially businesses focused on staycations are beginning to see their sales recover as consumers make plans for travel.

- Throughout the pandemic, cart and browse recovery strategies have been more effective than usual and many more shoppers have been identified.

These numbers can act as a benchmark for your business, but what can you do to engage with your customers as we return to a new normal? What online channels will you use, and how will that compare to shopping in-store?

Fresh Relevance is here to help, with advice on 3 areas to focus your ecommerce marketing on in a post pandemic world, making the most of a tough situation and ecommerce marketing in a new era.